ALLAN RAY

The Uk's Impending Turn To Hard Socialism

A Marxist named Keir Starmer is most certainly on his way to becoming the United Kingdom's next prime minister.

ALLAN RAY

A Marxist named Keir Starmer is most certainly on his way to becoming the United Kingdom's next prime minister.

GRANT JOHNSON

A couple based blockbusters suggest Hollywood is changing course for some very particular reasons.

THOMAS CARTER

When Donald Trump allegedly paid to have the Stormy Daniels allegations killed, it was election interference.

NICK EDWARD

Etymology teaches us the deep and dark history of slavery. A history that does not belong exclusively to one race.

ALLAN RAY

It's not just Hollywood. There is a known problem inside youth sports and religious institutions.

RYAN TYLER

With both of their parties sinking in the polls, Trudeau and Singh are looking to change the rules of democracy.

NICK EDWARD

Allies of a democratic country may not know who they're dealing with, as their partner switches personalities every four to eight years.

THOMAS CARTER

Is Donald Trump's fate preordained? Are these legal attacks designed to fail?

GRANT JOHNSON

In Rachel Notley's absence, a new series of problems could emerge for Alberta's steadfast conservatives.

JOHN MILLER

Written in 2016, this book foresaw much of the past few years unfolding with impressive accuracy.

NICK EDWARD

As many who flee are healthy men, we seem quick to cast judgement on some Ukrainian refugees.

ALLAN RAY

The new year is a perfect time to take your emotions out of your decision-making. Learn how.

RYAN TYLER

If these countries haven't been able to achieve self-sufficiency after everything we have spent, too bad.

NICK EDWARD

Never mind what they're doing and thinking, focus on yourself. Your own goals, aspirations and progress should matter more than anything else.

GRANT JOHNSON

Take Back Alberta is laser focused on protecting children from the depravity that is infecting our society.

DEVON KASH

Many will argue that fluoride occurs naturally in everything, but this type of fluoride does not.

RYAN TYLER

Little has changed since Elon Musk took over the platform formerly known as Twitter.

RYAN TYLER

The prime minister might be on a mission to punish everyone, including his own party.

GRANT JOHNSON

Starting in Alberta, conservatives must act to eradicate the dangerous and degenerate ideology of socialism.

STEVE PARKER

Voters in Burlington need to get the job done.

GRANT JOHNSON

Stocking up on gold could save you in hard times. It has proven itself as a reliable hedge against inflation.

RYAN TYLER

As she escapes the matrix, we encounter some old-fashioned messages and themes.

THOMAS CARTER

He was popular and a favourite to replace a disqualified Trump, until he wasn't.

ALLAN RAY

For some odd reason, they like to defend predators and downplay trafficking.

STEVE PARKER

Failing at the box office, at their theme parks and with their streaming service, Disney's nonsense has finally caught up.

RYAN TYLER

Sinking inflation and better unemployment numbers could fool Canadians into seeing Liberals as successful.

DEVON KASH

Concerns about people having their incomes cut off for wrong-think under a UBI are legitimate.

GRANT JOHNSON

She beat all the odds and won against the NDP's smears, but will she use her four years wisely?

NICK EDWARD

Weaponized Pride has created a more hostile environment for the LGBTQ movement.

ALLAN RAY

A hypothetical discussion is being had among some fringe activists and academics about erasing the word.

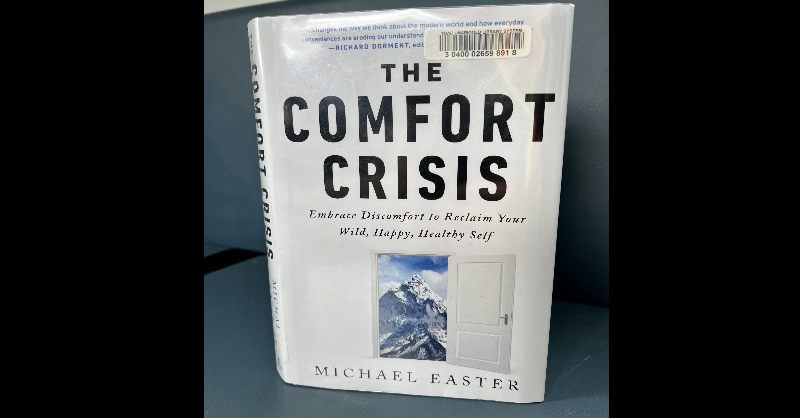

JOHN MILLER

This is a review of the book by Michael Easter.

GRANT JOHNSON

A flu turned us against each other. Every man should be prepared to protect his family from something worse.

ALLAN RAY

The former governor general has proved himself a Liberal crony.

DEVON KASH

Carla Beck hasn't managed to stir up confidence or enthusiasm among the party's core base.