RYAN TYLER

Barbie Isn't As Woke As You Think

As she escapes the matrix, we encounter some old-fashioned messages and themes.

RYAN TYLER

As she escapes the matrix, we encounter some old-fashioned messages and themes.

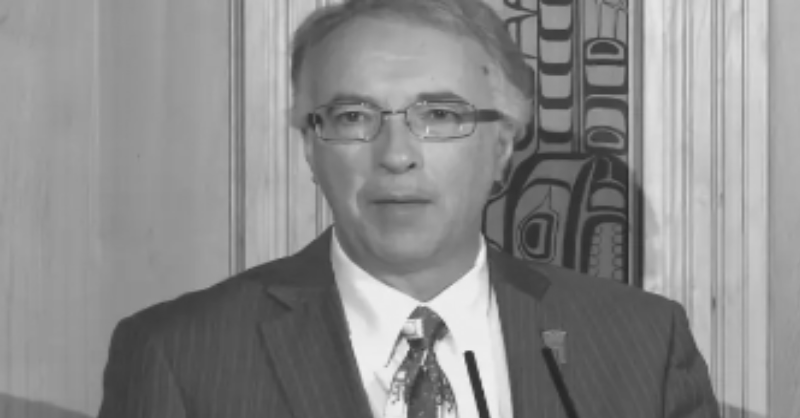

THOMAS CARTER

He was popular and a favourite to replace a disqualified Trump, until he wasn't.

ALLAN RAY

For some odd reason, they like to defend predators and downplay trafficking.

RYAN TYLER

We've been doing it wrong for hundreds of years and it doesn't look like we are going to stop.

DEVON KASH

Concerns about people having their incomes cut off for wrong-think under a UBI are legitimate.

NICK EDWARD

Weaponized Pride has created a more hostile environment for the LGBTQ movement.

ALLAN RAY

A hypothetical discussion is being had among some fringe activists and academics about erasing the word.

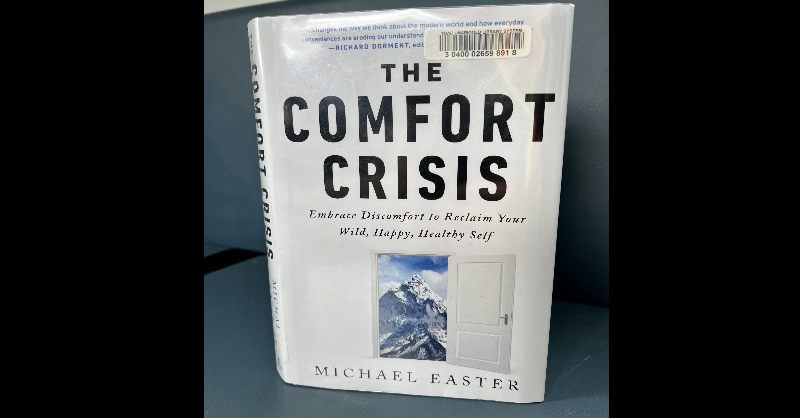

JOHN MILLER

This is a review of the book by Michael Easter.

RYAN TYLER

Since 1977, conservatives have been outnumbered in Manitoba. They need to make a big decision.

ALLAN RAY

The former governor general has proved himself a Liberal crony.

RYAN TYLER

They don't deserve our forgiveness.

DEVON KASH

Carla Beck hasn't managed to stir up confidence or enthusiasm among the party's core base.

GRANT JOHNSON

Fewer people amount to fewer problems. A smaller population might be exactly what we need.

ALLAN RAY

Billions have been wasted on corporate interests while our trust in science has been broken.

STEVE PARKER

The comedian seems unable to comprehend why whites would be dissatisfied with a white government.

RYAN TYLER

As biological men invade women's spaces and erase what it means to be a woman, men do nothing.

ALLAN RAY

The NDP's disastrous policies need to be undone, but only one party offers a path to victory.

GRANT JOHNSON

Conservative think they have the next election in the bag. but they don't realize the odds are stacked against them.

RYAN TYLER

The plan has been in place for decades and it's finally starting to work, but not in the ways you might think.

DEVON KASH

The company has done much worse than reject basic biology and science.

RYAN TYLER

After ten years of Stephen Harper, Canada is more insane and progressive than ever before.